In this insight we review the performance of the Australian banks versus the Canadian banks and discuss why Canadian bank investors should consider the Hamilton Australian Bank Equal-Weight Index ETF (ticker: HBA). Launched on June 29, 2020, HBA aims to replicate (net of fees) the performance of the Solactive Australian Bank Equal-Weight Index TR (SOLBAEWT) and is currency hedged. The SOLBAEWT index, which tracks the performance…

Insights & Commentary

Hamilton Global Financials ETF (HFG): Merging Two Global ETFs with Material Outperformance

On June 29, 2020, the Hamilton Global Financials ETF will begin trading on the TSX under the ticker HFG. This new ETF will have a lower management fee and will be the result of a merger between the Hamilton Global Bank ETF (HBG) and the Hamilton Global Financials Yield ETF (HFY) – both of which have experienced material outperformance. Since its launch in January 2016, the Hamilton…

Canadian Banks: Outperformance from Mean Reversion (in 7 Charts)

As all Canadian investors know, the stock prices of the Canadian banks are highly correlated, and the individual banks have generated similar returns over long periods of time. Over the past several decades, the Canadian banks that have underperformed tended to catch up to those that outperformed, and vice versa – i.e., their performance was “mean reverting”. In this Insight, we discuss these mean reversion tendencies…

Hamilton ETFs Launches Hamilton Financials Innovation ETF

TORONTO, June 1, 2020 – Hamilton Capital Partners Inc. (“Hamilton ETFs“) is pleased to announce the launch of the Hamilton Financials Innovation ETF (“HFT“). HFT seeks long-term returns from an actively managed equity portfolio by investing in companies located anywhere in the world that are innovating and supporting the financial services sector primarily through the use of data and technology. HFT has closed the offering of…

Canadian Banks: Three Vulnerable Loan Exposures (in Charts)

In our Insight, Financials: Does COVID-19 Represent a Growth Scare, Credit Event or Crisis (March 25, 2020), we discussed the implications of the global economy moving swiftly into an undetermined period of negative economic growth. For the banks, we fully expect the result will be a credit cycle. Although the peak of losses and the duration are very much unknown, we believe this credit cycle is likely…

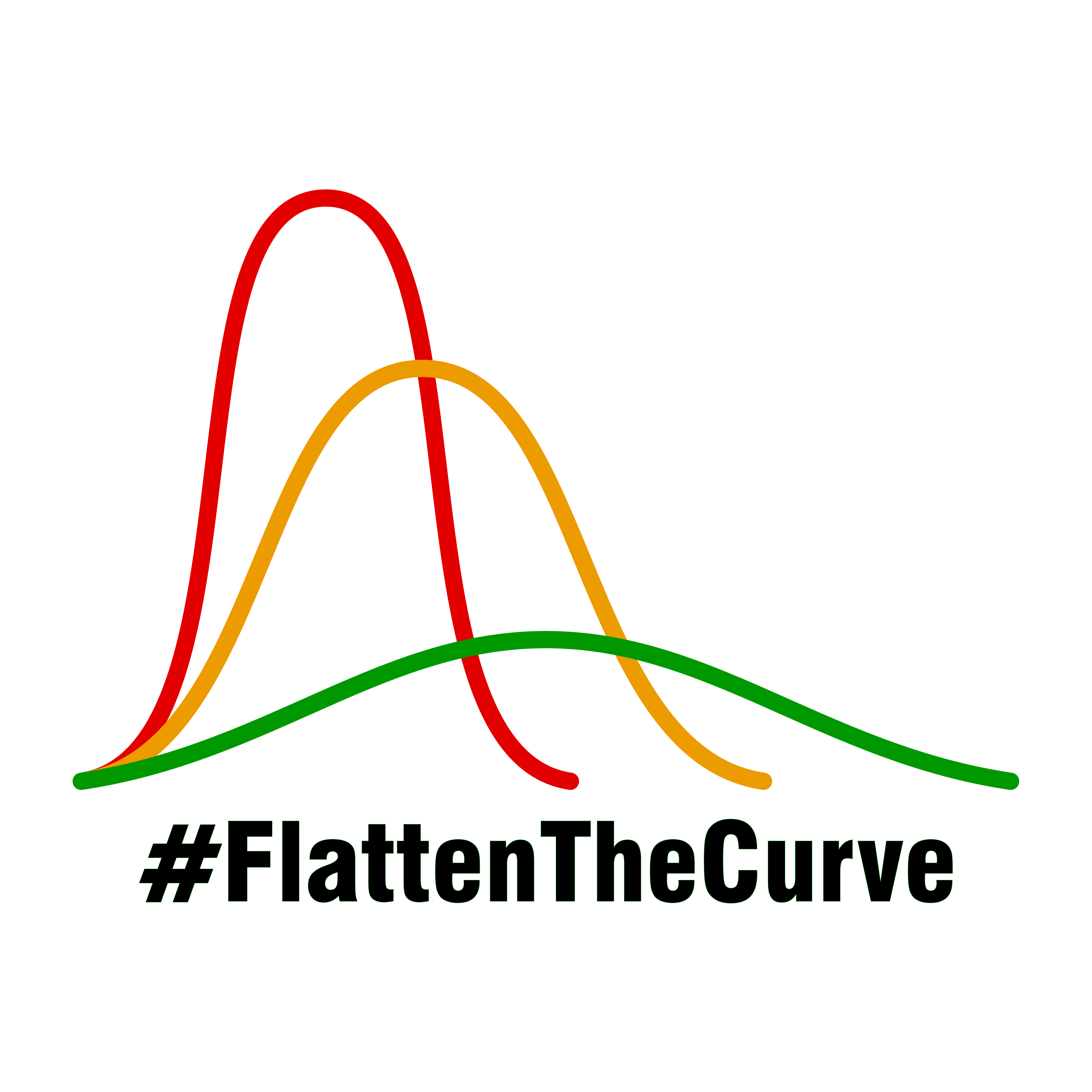

One Chart: Australia Appears to be Flattening the Curve Ahead of Other Countries (including Canada)

In our Insight, “Financials: Does COVID-19 Represent a Growth Scare, Credit Event or Crisis” (March 25, 2020), we discussed the implications of the global economy moving swiftly into an undetermined period of negative economic growth which has caused stocks to fall sharply. One critical variable for every country will be when they can restart their economies, which will be heavily influenced by each country’s ability to…

Financials: Does COVID-19 Represent a Growth Scare, Credit Event or Crisis?

Since we launched our first ETF in January 2016, there have been four significant macro corrections in four years. None of those large and painful corrections represented a crisis, insofar as the declines did not represent a threat to the solvency of the financial sector, either from a lack of liquidity or the destruction of capital. Rather, they were related to the market rapidly (and, in…

Update: HFA Outperforming the Canadian Banks with Lower Volatility (in Charts)

The Hamilton Australian Financials Yield ETF (HFA) invests in one of the world’s best financial sectors, anchored by some of the world’s best capitalized banks. As evidence of the quality of the Australian financial sector, the Australian banks outperformed the Canadian banks during the global financial crisis. This strong historical performance is underpinned by the fact Australia is a higher performing economy, with GDP growth consistently…

One Chart: When/Where the Canadian Banks Spent US$32 bln on U.S. Banks

All Canadian bank investors know that expansion into the U.S. personal and commercial (“P&C”) banking sector remains the focal point of capital deployment for the Canadian banks. In fact, US banking has been – by far – the largest destination of capital deployment since 2004 (when TD Bank acquired a majority stake in Banknorth), with the Canadian banks having spent a huge US$30 bln. The chart…

One Chart: U.S. Bank M&A Doubles in 2019 (and Why We Expect More)

In the 10+ years since the global financial crisis, deal values in U.S. bank M&A have been slow to reach pre-crisis levels. This is notable since in the nearly 25 years preceding the financial crisis bank M&A was an important theme (particularly between 1995 to 2007) as the chart below highlights. Note to Reader: This Insight includes references to certain Hamilton ETFs that were active at…

Hamilton Global Financials Yield ETF (HFY): Strong Q4 Closes out an Excellent Two Years

For the quarter ended December 31, 2019, the Hamilton Global Financials Yield ETF (HFY) returned 4.1% including distributions. In 2019, HFY returned 21.6%, beating the Canadian banks by 750 bps[1]. It also beat its benchmark, the KBW Financial Sector Dividend Yield Total Return Index (in CAD), which returned 15.0%. Note to Reader: This Insight includes references to certain Hamilton ETFs that were active at the time of writing.…

Notes from India: All is Well in the World’s Fastest Growing Market

We had the opportunity to meet the management teams of a dozen Indian banks, insurers and asset managers in the financial capital of Mumbai, India last month. Nearly a year since our last meetings with senior bank executives and notwithstanding the recent slowing of economic growth, management teams were optimistic of India’s medium to long-term GDP growth outlook. The optimism was driven by a structural market…