Hamilton Canadian Bank

Mean Reversion Index ETF

A Smarter Way to Invest in Canadian Banks

Highlights

Canadian bank ETF with exposure to the “Big Six” banks using a mean reversion strategy

+15.07% annualized return since inception *As at June 30, 2023

5.70% yield with monthly distributions*An estimate of the annualized yield an investor would receive if the most recent distribution remained unchanged for the next 12 months, stated as a percentage of the price per unit on June 30, 2023

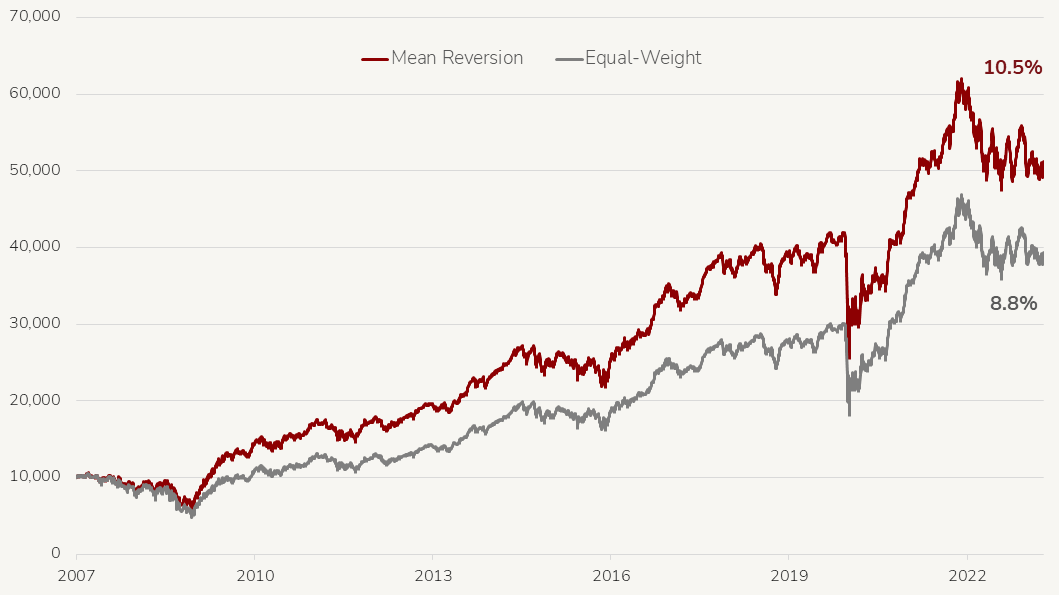

Mean reversion has long-term outperformance vs. equal weight strategies*Annualized returns of Solactive Canadian Bank Mean Reversion Index TR (SOLCBMRT) since inception on March 16, 2007 vs Solactive Equal Weight Canada Banks Index (SOLCBEW) as at March 31, 2023; source: Bloomberg, Solactive AG

Potential for higher long-term returns

What is Mean-Reversion?

Mean reversion is one of the most popular themes in Canadian bank investing, given the individual Canadian banks have tended to perform similarly over time.

HCA attempts to take advantage of these tendencies by rebalancing the portfolio quarterly and investing 80% of the portfolio in the 3 banks which have recently underperformed, and 20% in the 3 banks which have outperformed.

FUND OBJECTIVE

The fund is designed to closely track the returns of the Solactive Canadian Bank Mean Reversion Index TR, which applies a variable-weight, mean reversion trading strategy to Canada’s “Big Six” banks, with quarterly rebalancing.

The Solactive Canadian Bank Mean Reversion Index TR has outperformed an equal weight portfolio of Canada’s banks

Performance

- TICKER HCA

- NAV $21.09

- 1 DAY CHANGE +$0.08

-

YIELD *

Current annualized yield, as at June 30, 2023

5.70% - ASSETS $73.8M

Annualized Returns

- ticker 0.00%

- 1 month -1.94%

- 3 months 19.32%

- 6 months 2.92%

- year to date -1.94%

- 1 year 0.20%

- 3 years* 10.10%

- inception* 14.64%

- as of date 202400.00%

Solactive Canadian Bank Mean Reversion Index TR vs Solactive Equal Weight Canada Banks Index

Value of 10,000 of Solactive Canadian Bank Mean Reversion Index TR (SOLCBMRT) vs Solactive Equal Weight Canada Banks Index (SOLCBEW) with annual compounded total returns since inception on March 16, 2007, as at June 30, 2023. Source: Bloomberg, Solactive AG

- Overview

- Distributions

- Documents

| ticker | name | weight |

| BNS | Bank of Nova Scotia | 26.0% |

| NA | National Bank of Canada | 21.8% |

| TD | Toronto-Dominion Bank | 21.4% |

| CM | Canadian Imperial Bank of Commerce | 12.0% |

| RY | Royal Bank of Canada | 11.8% |

| BMO | Bank of Montreal | 6.7% |

| Ticker | HCA |

| Exchange | Toronto Stock Exchange (TSX) |

| CUSIP | 40704K100 |

| Inception Date | June 26, 2020 |

| Investment Style | Index-based, mean reversion strategy |

| Benchmark | Solactive Canadian Bank Mean Reversion Index |

| Assets | $73.8M CAD* |

| Current Annualized Yield | 5.70%* |

| Distributions | Monthly |

| Rebalancing | Quarterly |

| Management Fee | 0.29% |

| Risk Rating | Medium |

| Auditor | KPMG LLP |

| Legal Entity Identifier | 549300ZKTX737BJCLT27 |

| Ex-Dividend Date | Paid | Frequency | Amount |

|---|---|---|---|

| 2023-07-28 | 2023-08-08 | Monthly | $0.0960 |

| 2023-06-29 | 2023-07-10 | Special (cash) | $0.6000 |

| 2023-06-29 | 2023-07-10 | Monthly | $0.0960 |

| 2023-05-30 | 2023-06-07 | Monthly | $0.0960 |

| 2023-04-27 | 2023-05-05 | Monthly | $0.0960 |

| 2023-03-30 | 2023-04-13 | Monthly | $0.0960 |

| 2023-02-27 | 2023-03-10 | Monthly | $0.0960 |

| 2023-01-30 | 2023-02-10 | Monthly | $0.0960 |

| 2022-12-29 | 2023-01-12 | Monthly | $0.0960 |

| 2022-11-29 | 2022-12-12 | Monthly | $0.0960 |

| 2022-10-28 | 2022-11-10 | Monthly | $0.0960 |

| 2022-09-28 | 2022-10-13 | Monthly | $0.0960 |

| 2022-08-30 | 2022-09-13 | Monthly | $0.0960 |

| 2022-07-28 | 2022-08-11 | Monthly | $0.0960 |

| 2022-06-29 | 2022-07-13 | Monthly | $0.0960 |

| 2022-05-30 | 2022-06-10 | Monthly | $0.0925 |

| 2022-04-28 | 2022-05-11 | Monthly | $0.0925 |

| 2022-03-30 | 2022-04-12 | Monthly | $0.0925 |

| 2022-02-25 | 2022-03-10 | Monthly | $0.0925 |

| 2022-01-28 | 2022-02-10 | Monthly | $0.090 |

| 2021-12-30 | 2022-01-13 | Special (non-cash) | $1.80801 |

| 2021-12-30 | 2022-01-13 | Monthly | $0.090 |

| 2021-11-29 | 2021-12-10 | Monthly | $0.085 |

| 2021-10-28 | 2021-11-10 | Monthly | $0.080 |

| 2021-09-28 | 2021-10-13 | Monthly | $0.080 |

| 2021-08-30 | 2021-09-13 | Monthly | $0.080 |

| 2021-07-29 | 2021-08-12 | Monthly | $0.080 |

| 2021-06-29 | 2021-07-13 | Monthly | $0.080 |

| 2021-05-28 | 2021-06-10 | Monthly | $0.080 |

| 2021-04-29 | 2021-05-12 | Special (cash) | $0.100 |

| 2021-04-29 | 2021-05-12 | Monthly | $0.075 |

| 2021-03-30 | 2021-04-13 | Monthly | $0.075 |

| 2021-02-25 | 2021-03-10 | Monthly | $0.072 |

| 2021-01-28 | 2021-02-10 | Monthly | $0.072 |

| 2020-12-30 | 2021-01-13 | Special (cash) | $0.26041 |

| 2020-12-30 | 2021-01-13 | Monthly | $0.072 |

| 2020-11-27 | 2020-12-10 | Monthly | $0.072 |

| 2020-10-29 | 2020-11-12 | Monthly | $0.072 |

| 2020-09-29 | 2020-10-13 | Monthly | $0.070 |

| 2020-08-28 | 2020-09-11 | Monthly | $0.070 |

You can view public filings for the Hamilton Canadian Bank Mean Reversion Index ETF on SEDAR.

Press Releases

View the latest HCA Press Releases

Fact Sheet

HCA Fact Sheet (2023-06-30) English Français

ETF Facts

HCA ETF Facts (2023-03-27) English Français

Prospectus

HCA Prospectus (2023-03-27) English Français

Financial Statements

Annual Financial Statements (2022-12-31) English Français

Interim Financial Statements (2022-06-30) English Français

Latest Portfolio Summary

Q1 2023 Portfolio Summary (2023-03-31) Download

Independent Review Committee

2022 Annual Report to Securityholders (2023-03-21) Download