Hamilton Enhanced

Utilities ETF

Get More from Canadian Utilities

HIGHLIGHTS

Exposure to 12 high dividend-paying Canadian Utility, Telecom, and Pipeline companies

Modest 25% cash leverage to enhance yield and return potential

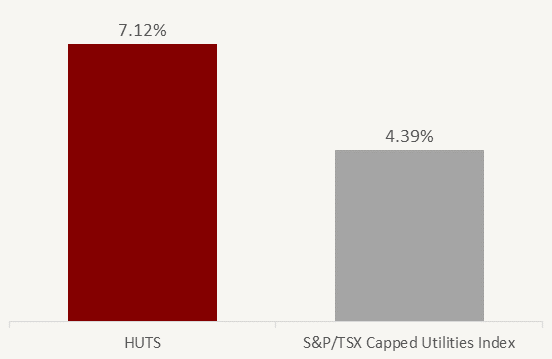

Yield of 7.12%*An estimate of the annualized yield an investor would receive if the most recent distribution remained unchanged for the next 12 months, stated as a percentage of the price per unit on June 30, 2023 with monthly distributions

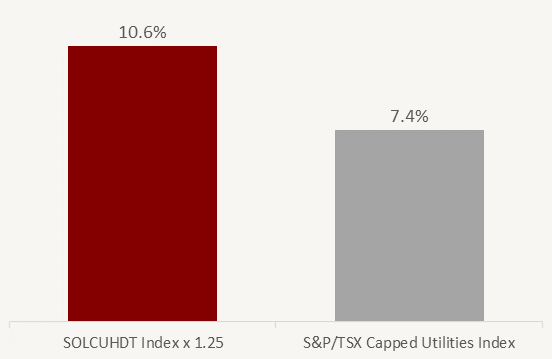

Solactive Canadian Utility Services High Dividend Index TR x 1.25 has outperformed the S&P/TSX Capped Utilities Index by 3.08%*Based on annualized returns since inception on December 7, 2011, as at June 30, 2023

A GOOD FIT FOR INVESTORS WHO WANT

Stable and consistent dividends from a relatively defensive sector

Enhanced yield and growth potential

Favourable tax treatment of Canadian sourced dividends

FUND OBJECTIVE

The investment objective of HUTS is to replicate, to the extent reasonably possible and before the deduction of fees and expenses, a 1.25 times multiple of a rules-based utilities index, currently the Solactive Canadian Utility Services High Dividend Index TR (SOLCUHDT).

Performance

- TICKER HUTS

- NAV $12.00

- 1 DAY CHANGE -$0.01

-

YIELD *

Current annualized yield, as at June 30, 2023

7.12% - ASSETS $79.6M

Annualized Returns

- ticker 0.00%

- 1 month 0.59%

- 3 months 16.00%

- 6 months -0.13%

- year to date 0.59%

- 1 year -8.29%

- inception* -11.60%

- as of date 202400.00%

Index Outperformance1

since August 2012

1Annualized returns based on the Solactive Canadian Utility Services High Dividend Index TR (SOLCUHDT) x 1.25 versus the S&P/TSX Capped Utilities Index (TTUTAR), from August 15, 2012 to June 30, 2023. Source: Bloomberg, Solactive AG, Hamilton ETFs

Higher Yield2

2Current annualized yields as at June 30, 2023. Source: Bloomberg, Hamilton ETFs

- Overview

- Distributions

- Documents

█ Telecoms 24.1%

█ Utilities 50.7%

| ticker | name | weight |

| BIP-U | Brookfield Infrastructure Part | 11.6% |

| H | Hydro One Ltd | 10.7% |

| TRP | TC Energy Corp | 10.6% |

| PPL | Pembina Pipeline Corp | 10.5% |

| BEP-U | Brookfield Renewable Partners | 10.5% |

| RCI/B | Rogers Communications Inc | 10.5% |

| ALA | AltaGas Ltd | 10.4% |

| ENB | Enbridge Inc | 10.4% |

| EMA | Emera Inc | 10.1% |

| FTS | Fortis Inc/Canada | 10.1% |

| BCE | BCE Inc | 10.1% |

| T | TELUS Corp | 9.7% |

| Ticker | HUTS |

| Exchange | Toronto Stock Exchange (TSX) |

| CUSIP | 40737J104 |

| Inception Date | September 1, 2022 |

| Investment Style | Index-based, modest 25% leverage |

| Index | Solactive Canadian Utility Services High Dividend Index TR |

| Assets | $79.6M CAD* |

| Current Annualized Yield | 7.12%* |

| Distributions | Monthly |

| Rebalancing | Semi-Annual |

| Management Fee | 0.65%* |

| Risk Rating | Medium |

| Auditor | KPMG LLP |

| Legal Entity Identifier | 549300CVZNB3BWAKSN86 |

| Ex-Dividend Date | Paid | Frequency | Amount |

|---|---|---|---|

| 2023-07-28 | 2023-08-08 | Monthly | $0.079 |

| 2023-06-29 | 2023-07-10 | Monthly | $0.079 |

| 2023-05-30 | 2023-06-07 | Monthly | $0.079 |

| 2023-04-27 | 2023-05-05 | Monthly | $0.079 |

| 2023-03-30 | 2023-04-13 | Monthly | $0.079 |

| 2023-02-27 | 2023-03-10 | Monthly | $0.079 |

| 2023-01-30 | 2023-02-10 | Monthly | $0.079 |

| 2022-12-29 | 2023-01-12 | Monthly | $0.079 |

| 2022-11-29 | 2022-12-12 | Monthly | $0.079 |

| 2022-10-28 | 2022-11-10 | Monthly | $0.079 |

You can view public filings for the Hamilton Enhanced Canadian Utilities ETF on SEDAR.

Press Releases

View the latest HUTS Press Releases

Fact Sheet

HUTS Fact Sheet (2023-06-30) English Français

ETF Facts

HUTS ETF Facts (2023-06-07) English Français

Prospectus

HUTS Prospectus (2023-06-07) English Français

Financial Statements

Annual Financial Statements (2022-12-31) English Français

Latest Portfolio Summary

Q1 2023 Portfolio Summary (2023-03-31) Download

Independent Review Committee

2022 Annual Report to Securityholders (2023-03-21) Download