Hamilton Enhanced

Canadian Bank ETF

Top Performing Canadian Bank ETF

Highlights

Top performing Canadian bank ETF, with a +15.98% annualized total return*Since inception on October 14, 2020, as at June 30, 2023. Based on a universe of seven Canadian bank ETFs that trade on the Toronto Stock Exchange. Effective April 14, 2023, the investment objective of the Hamilton Enhanced Canadian Bank ETF (HCAL) was changed to equal weight exposure from its prior mean reversion approach. In certain markets, the current approach is expected to outperform the prior.

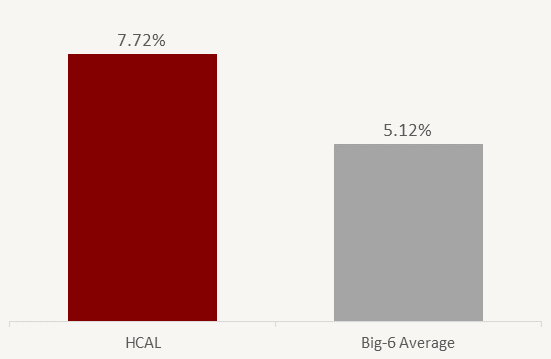

HCAL outperformed the average of the Big-6 Canadian banks with similar volatility *Volatility is the annualized standard deviation of daily returns since Oct 14, 2020. Big-6 average is the Solactive Equal Weight Canada Banks Index (SOLCBEW). As at June 30, 2023. Source: Bloomberg, Hamilton ETFs

Yield of 7.72%*An estimate of the annualized yield an investor would receive if the most recent distribution remained unchanged for the next 12 months, stated as a percentage of the price per unit on June 30, 2023

Equal-weight exposure to Canada’s “Big Six” banks with modest 25% cash leverage

A GOOD FIT FOR INVESTORS WHO WANT

Enhanced growth potential and higher monthly income

Monthly distributions

FUND OBJECTIVE

HCAL is designed to track 1.25x the returns of the Solactive Equal Weight Canada Banks Index, investing in Canadian banks — using modest 25% cash leverage. HCAL does not use derivatives.*Effective April 14, 2023, the investment objective of the Hamilton Enhanced Canadian Bank ETF (HCAL) was changed. Please refer to the disclosure documents of HCAL at www.hamilton.fundzen.com.

Performance

- TICKER HCAL

- NAV $20.49

- 1 DAY CHANGE +$0.11

-

YIELD *

Current annualized yield, as at June 30, 2023

7.72% - ASSETS $508.0M

Annualized Returns

- ticker 0.00%

- 1 month -2.46%

- 3 months 22.40%

- 6 months 1.47%

- year to date -2.46%

- 1 year -3.02%

- 3 years* 10.75%

- inception* 15.07%

- as of date 202400.00%

Higher Yield1

1Big-6 average is the Solactive Equal Weight Canada Banks Index (SOLCBEW). As at June 30, 2023. Source: Bloomberg, Hamilton ETFs

- Overview

- Distributions

- Documents

| ticker | name | weight |

| HEB | Hamilton Canadian Bank Equal-Weight Index ETF | 125.3% |

Leverage is via cash borrowing (not derivatives), provided by a Canadian financial institution.

HEB Holdings

Hamilton Canadian Bank Equal-Weight Index ETF invests in Canada's "big six" banks| Name | Weight |

|---|---|

| Bank of Nova Scotia | 17.2% |

| Canadian Imperial Bank of Commerce | 16.7% |

| National Bank of Canada | 16.7% |

| Toronto-Dominion Bank | 16.7% |

| Bank of Montreal | 16.6% |

| Royal Bank of Canada | 16.1% |

| Ticker | HCAL |

| Exchange | Toronto Stock Exchange (TSX) |

| CUSIP | 407363100 |

| Inception Date | October 14, 2020 |

| Investment Style | Index-based, 25% modest leverage |

| Index | Solactive Equal Weight Canada Banks Index |

| Assets | $508.0M CAD* |

| Current Annualized Yield | 7.72%* |

| Distributions | Monthly |

| Management Fee | 0.65% |

| Risk Rating | Medium to High |

| Auditor | KPMG LLP |

| Legal Entity Identifier | 549300JNYPYDVKHHRV07 |

| Ex-Dividend Date | Paid | Frequency | Amount |

|---|---|---|---|

| 2023-07-28 | 2023-08-08 | Monthly | $0.1270 |

| 2023-06-29 | 2023-07-10 | Monthly | $0.1270 |

| 2023-05-30 | 2023-06-07 | Monthly | $0.1270 |

| 2023-04-27 | 2023-05-05 | Monthly | $0.1270 |

| 2023-03-30 | 2023-04-13 | Monthly | $0.1270 |

| 2023-02-27 | 2023-03-10 | Monthly | $0.1270 |

| 2023-01-30 | 2023-02-10 | Monthly | $0.1270 |

| 2022-12-29 | 2023-01-12 | Monthly | $0.1270 |

| 2022-11-29 | 2022-12-12 | Monthly | $0.1270 |

| 2022-10-28 | 2022-11-10 | Monthly | $0.1270 |

| 2022-09-28 | 2022-10-13 | Monthly | $0.1270 |

| 2022-08-30 | 2022-09-13 | Monthly | $0.1270 |

| 2022-07-28 | 2022-08-11 | Monthly | $0.1270 |

| 2022-06-29 | 2022-07-13 | Monthly | $0.1270 |

| 2022-05-30 | 2022-06-10 | Monthly | $0.1225 |

| 2022-04-28 | 2022-05-11 | Monthly | $0.1225 |

| 2022-03-30 | 2022-04-12 | Monthly | $0.1225 |

| 2022-02-25 | 2022-03-10 | Monthly | $0.1225 |

| 2022-01-28 | 2022-02-10 | Monthly | $0.115 |

| 2021-12-30 | 2022-01-13 | Special (non-cash) | $2.29452 |

| 2021-12-30 | 2022-01-13 | Monthly | $0.115 |

| 2021-11-29 | 2021-12-10 | Monthly | $0.1075 |

| 2021-10-28 | 2021-11-10 | Monthly | $0.100 |

| 2021-09-28 | 2021-10-13 | Monthly | $0.100 |

| 2021-08-30 | 2021-09-13 | Monthly | $0.100 |

| 2021-07-29 | 2021-08-12 | Monthly | $0.100 |

| 2021-06-29 | 2021-07-13 | Monthly | $0.100 |

| 2021-05-28 | 2021-06-10 | Monthly | $0.100 |

| 2021-04-29 | 2021-05-12 | Special (cash) | $0.110 |

| 2021-04-29 | 2021-05-12 | Monthly | $0.093 |

| 2021-03-30 | 2021-04-13 | Monthly | $0.093 |

| 2021-02-25 | 2021-03-10 | Monthly | $0.087 |

| 2021-01-28 | 2021-02-10 | Monthly | $0.087 |

| 2020-12-30 | 2021-01-13 | Special (cash) | $0.30745 |

| 2020-12-30 | 2021-01-13 | Monthly | $0.087 |

You can view public filings for the Hamilton Enhanced Canadian Bank ETF on SEDAR.

Press Releases

View the latest HCAL Press Releases

Fact Sheet

HCAL Fact Sheet (2023-06-30) English Français

ETF Facts

HCAL ETF Facts (2023-06-07) English Français

Prospectus

HCAL Prospectus (2023-06-07) English Français

A special meeting of HCAL unitholders was held on February 15, 2023. For further details, please see the Management Information Circular.

Financial Statements

Annual Financial Statements (2022-12-31) English Français

Interim Financial Statements (2022-06-30) English Français

Latest Portfolio Summary

Q1 2023 Portfolio Summary (2023-03-31) Download

Independent Review Committee

2022 Annual Report to Securityholders (2023-03-21) Download