As investors in HDIV and HYLD know, we aim to create higher income ETF versions of the S&P/TSX 60 and S&P 500, respectively by investing in various covered call strategies. Today’s insight discusses the recent changes to HYLD’s portfolio, and why we believe they will help better achieve HYLD’s investment objective of providing attractive monthly income and the opportunity for long-term capital appreciation.

Adding JPMorgan Equity Premium Income ETF (JEPI); Selling Harvest Brand Leaders Plus Income ETF (HBF)

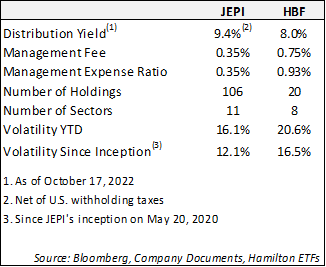

As part of HYLD’s ongoing review, we have recently added JPMorgan Premium Income ETF (JEPI) and sold the Harvest Brand Leaders Plus Income ETF (HBF). In our opinion, JEPI offers several advantages over HBF, as highlighted in the chart. Specifically, JEPI has: (i) a higher distribution yield (9.4% vs 8.0%, as of October 17th); (ii) a significantly lower management expense ratio or MER (0.35%, or roughly a third of HBF’s 0.93%[1]); (iii) greater diversification (both by position and sector); and (iv) materially lower volatility (since JEPI’s launch)[2]. JEPI’s addition also helps align HYLD’s sector mix more closely to that of the S&P 500.

Notwithstanding the fact that past performance is not indicative of future performance, since it was launched in May 2020, JEPI has outperformed HBF by nearly 1.7% annualized (in their respective local currencies). JEPI has also significantly outperformed year-to-date, declining 10.8% this year, versus HBF down 19.3%[3]. Considering HBF’s materially higher volatility, particularly this year, it is possible that HBF outperforms JEPI over a period should market conditions change. However, given the market uncertainty and most importantly JEPI’s other advantages discussed above – including a higher yield – we believe JEPI is a preferred holding for HYLD over the long-term.

Other HYLD Changes: Modestly Increase Energy, Reduce Healthcare

To further align HYLD’s overall sector mix closer to that of the S&P 500, we have recently introduced a new position in energy and funded it with a reduction in HYLD’s healthcare exposure. Specifically, we have added a 3.0% position in the CI Energy Giants Covered Call ETF (NXF) and sold a similar percentage of the Harvest Healthcare Leaders Income ETF (HHL).

HYLD: Stronger Underlying Distributions, Reduction in Fees, Greater Diversification

We believe these changes strengthen the Hamilton Enhanced U.S. Covered Call ETF (HYLD), by increasing its underlying distribution yield, providing greater diversification (by sector and position) and increasing its correlation to the S&P 500. They will also reduce the weighted average management expense ratio.

HYLD is offered in Canadian and U.S. dollar versions (HYLD is CAD hedged, while HYLD.U is USD unhedged). The current yield of HYLD is 14.73%[4], paid monthly. Investors seeking to ensure their monthly distributions are not impacted by changes in the Canadian dollar are likely to prefer HYLD. Investors that seek direct U.S. exposure including currency are likely to prefer HYLD.U.

It is our view that the sector mixes of the Canadian and U.S. equity markets are highly complementary, and therefore, we believe HDIV and HYLD held together can be core holdings for investors seeking higher income versions of the Canadian and U.S. equity indices.

The current yield of Hamilton Enhanced U.S. Covered Call ETF (HYLD) is 14.73%, paid monthly.

The current yield of Hamilton Enhanced Multi-Sector Covered Call ETF (HDIV) is 10.21%, paid monthly[5]. Since HDIV was launched in July 2021, it has outperformed the S&P/TSX 60 index by over 3%.

____

[1] As of June 30, 2022

[2] Volatility as measured by the annualized standard deviation of returns.

[3] As of October 17, 2022

[4] As of October 17, 2022

[5] As of October 17, 2022

Commissions, trailing commissions, management fees and expenses all may be associated with an investment in the ETFs. The relevant prospectus contains important detailed information about each ETF. Please read the relevant prospectus before investing. The ETFs are not guaranteed, their values change frequently and past performance may not be repeated.

Certain statements contained in this insight constitute forward-looking information within the meaning of Canadian securities laws. Forward-looking information may relate to a future outlook and anticipated distributions, events or results and may include statements regarding future financial performance. In some cases, forward-looking information can be identified by terms such as “may”, “will”, “should”, “expect”, “anticipate”, “believe”, “intend” or other similar expressions concerning matters that are not historical facts. Actual results may vary from such forward-looking information. Hamilton ETFs undertakes no obligation to update publicly or otherwise revise any forward-looking statement whether as a result of new information, future events or other such factors which affect this information, except as required by law.