For years, European banks faced significant challenges, from the Global Financial Crisis (GFC) to the European sovereign debt crisis and a prolonged period of ultra-low interest rates. However, through strengthened regulations, improved capital buffers, and operational resilience, they have emerged as stronger and more competitive financial institutions.

Today, the European banking sector, as represented by the STOXX Europe 600 Banks Index, is experiencing a notable resurgence. With interest rates normalizing, lending profitability has improved, driving sector return-on-equity (ROE) into the low double-digit range in 2024. This momentum has translated to impressive market performance, with European banks outperforming their U.S. and Canadian counterparts over the past one, three, and five years[1].

HFG — Hamilton Global Financials ETF

For investors looking to gain exposure to European banks while maintaining a diversified global financials position, the Hamilton Global Financials ETF (HFG) provides a compelling solution, in our view. HFG, with an approximately 15% allocation to European banks, invests in a carefully selected portfolio of global financial services firms with strong fundamentals, balancing diversification with disciplined risk management.

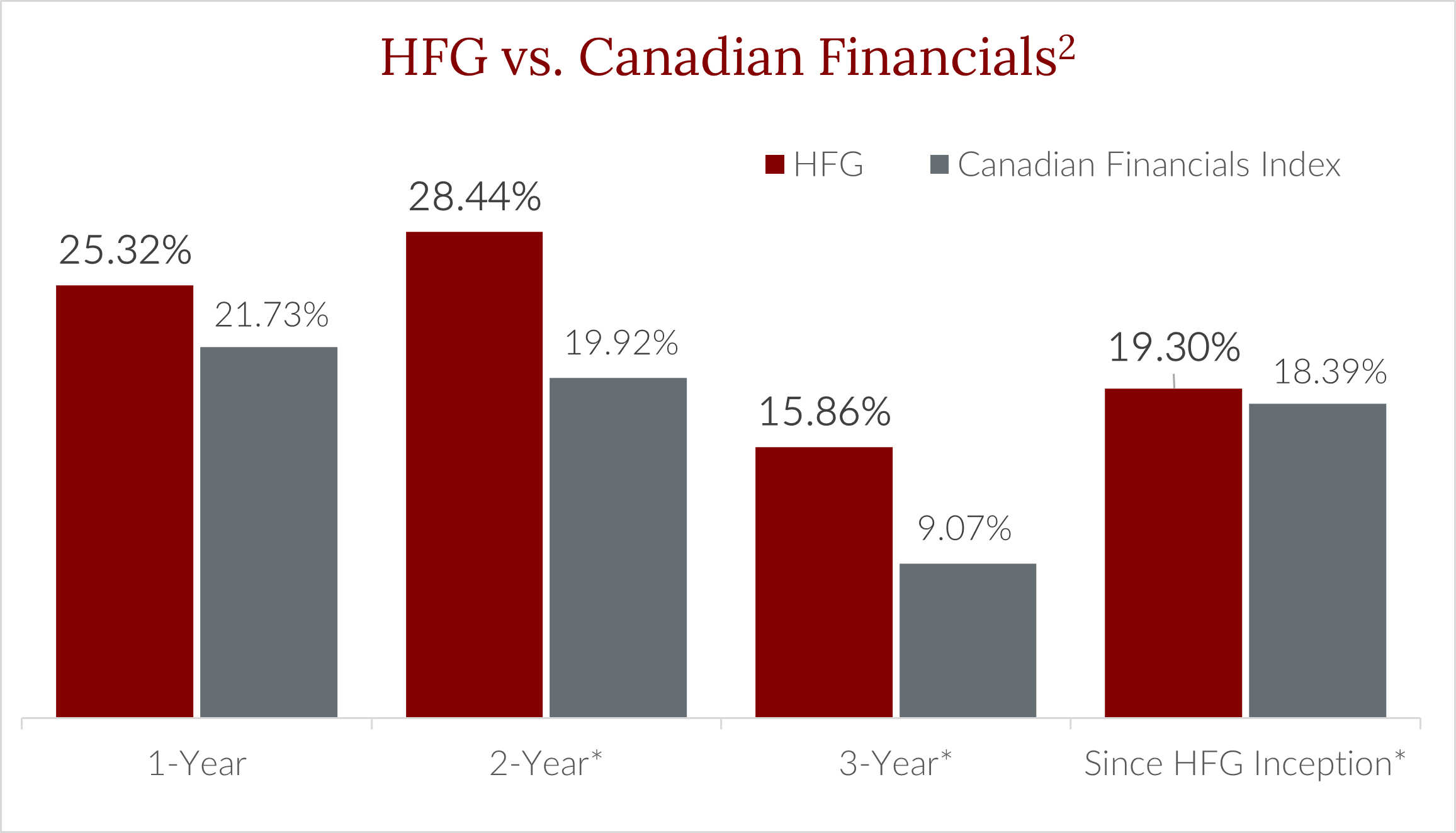

Since inception, HFG has delivered strong performance with an annualized return of over 19%, outperforming the Canadian financials index over the past one, two, and three years[2]. The fund was recently awarded the Fundata A+ rating for posting consistent risk-adjusted returns[3].

*Annualized

Valuation and Investment Appeal

European banks continue to trade at attractive valuation multiples, offering investors a unique opportunity relative to their North American counterparts. While their ROEs and capital levels are now comparable to the U.S. and Canadian banks, their price-to-earnings (P/E) and price-to-book (P/B) ratios remain significantly lower, suggesting room for further upside. Moreover, European banks have enhanced capital returns to shareholders through higher dividends and share buybacks, reinforcing their overall investment appeal.

While geopolitical uncertainty and modest economic growth persist, several structural tailwinds—such as potential resolutions to geopolitical tensions and adoption of a European banking union—could provide further support. A resolution to geopolitical tensions could unlock new lending opportunities, while a European banking union would have European banks regulated by a single regulator with a single resolution fund. This would likely accelerate M&A, which would improve efficiency and increase diversification.

HFG — A Diversified Global Financials Portfolio

European banks have demonstrated resilience and are now benefiting from improved profitability, attractive valuations, and stronger capital returns. For investors looking to diversify, we believe the Hamilton Global Financials ETF (HFG) provides an effective way to gain exposure to this opportunity while maintaining global diversification. Given its strong performance and strategic positioning, HFG remains a compelling complement to core Canadian financial holdings.

For more commentary, subscribe to our Insights.

____

A word on trading liquidity for ETFs …

Hamilton ETFs are highly liquid ETFs that can be purchased and sold easily. ETFs are as liquid as their underlying holdings and the underlying holdings trade millions of shares each day.

How does that work? When ETF investors are buying (or selling) in the market, they may transact with another ETF investor or a market maker for the ETF. At all times, even if daily volume appears low, there is a market maker – typically a large bank-owned investment dealer – willing to fill the other side of the ETF order (at net asset value plus a spread). The market maker then subscribes to create or redeem units in the ETF from the ETF manager (e.g., Hamilton ETFs), who purchases or sells the underlying holdings for the ETF.

____

Commissions, management fees and expenses all may be associated with investments in exchange traded funds (ETFs) managed by Hamilton ETFs. Please read the prospectus before investing. Indicated rates of return are the historical annual compounded total returns including changes in per unit value and reinvestment of all dividends or distributions and does not take into account sales, redemptions, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. Only the returns for periods of one year or greater are annualized returns. ETFs are not guaranteed, their values change frequently and past performance may not be repeated.

Certain statements contained in this website may constitute forward-looking information within the meaning of Canadian securities laws. Forward-looking information may relate to a future outlook and anticipated distributions, events or results and may include statements regarding future financial performance. In some cases, forward-looking information can be identified by terms such as “may”, “will”, “should”, “expect”, “anticipate”, “believe”, “intend” or other similar expressions concerning matters that are not historical facts. Actual results may vary from such forward-looking information. Hamilton ETFs undertakes no obligation to update publicly or otherwise revise any forward-looking statement whether as a result of new information, future events or other such factors which affect this information, except as required by law.

____

[1] Total returns of the STOXX Europe 600 Banks Index (SX7R) vs. the S&P/TSX Capped Financials TR Index (TTFSAR) and the Financial Select Sector TR Index (IXMTR), since June 26, 2020, as at March 31, 2025. Source: Bloomberg, Hamilton ETFs.

[2] Total returns of the Hamilton Global Financials ETF (HFG) vs. the S&P/TSX Capped Financials TR Index (TTFSAR), since June 26, 2020, as at March 31, 2025. Source: Bloomberg, Hamilton ETFs.

[3] For calendar year 2024 in the Financial Services Equity CIFSC Category (Fund Count: 33). FundGrade A+® is used with permission from Fundata Canada Inc., all rights reserved. The annual FundGrade A+® Awards are presented by Fundata Canada Inc. to recognize the “best of the best” among Canadian investment funds. The FundGrade A+® calculation is supplemental to the monthly FundGrade ratings and is calculated at the end of each calendar year. The FundGrade rating system evaluates funds based on their risk-adjusted performance, measured by Sharpe Ratio, Sortino Ratio, and Information Ratio. The score for each ratio is calculated individually, covering all time periods from 2 to 10 years. The scores are then weighted equally in calculating a monthly FundGrade. The top 10% of funds earn an A Grade; the next 20% of funds earn a B Grade; the next 40% of funds earn a C Grade; the next 20% of funds receive a D Grade; and the lowest 10% of funds receive an E Grade. To be eligible, a fund must have received a FundGrade rating every month in the previous year. The FundGrade A+® uses a GPA-style calculation, where each monthly FundGrade from “A” to “E” receives a score from 4 to 0, respectively. A fund’s average score for the year determines its GPA. Any fund with a GPA of 3.5 or greater is awarded a FundGrade A+® Award. For more information, see www.FundGradeAwards.com. Although Fundata makes every effort to ensure the accuracy and reliability of the data contained herein, the accuracy is not guaranteed by Fundata.