Since Hamilton U.S. Mid-Cap Financials ETF (USD) (ticker: HFMU.U) was launched in September 2017, the yield curve has flattened. Some market participants have taken this broader market signal to be an accurate predictor of a recession and by extension a credit cycle for banks. However, those interpreting the flattening of the yield curve (spread between the yield on the US 10 year and the Fed funds…

Insights: Hamilton ETFs

Australian Financials: History of Strong/Stable Dividend Growth

The Australian financial sector is among the highest quality and strongest in the world (and very similar to that of Canada). Moreover, Australia is one of the wealthiest countries in the world with GDP/capita nearly 20% higher than that of Canada. It is also forecast to be one of the world’s fastest growing developed economies in 2020 (at 2.4%), providing a supportive backdrop to the financial…

13th Straight Quarter of Double-Digit EPS Growth; Valuations at Five-Year Lows

Hamilton Global Bank ETF (ticker: HBG) holdings reported portfolio-weighted EPS growth of 10% Y/Y[1], driven by strong U.S. banks fundamentals (~60% weight) and a diversified portfolio of global banks (~40% weight). This is the 13th consecutive quarter of double-digit portfolio-weighted EPS growth for HBG. The strong growth was led by U.S. mid-caps and bank holdings in India, Norway and select European countries. Note to Reader: This…

Notes from Dallas: Big Things Happen Here

We recently returned from a visit to Dallas (our third in four years) where we met with eight banks operating in the Lone Star State. Five of the eight have footprints beyond Texas, and hence offered a fuller picture of the attractiveness of the Texas economy and business outlook (hint, there’s a reason they’re in Texas). Of the banks we met, three are holdings in our…

A Day in the Life of the U.S. Financials – Notes from New York

Three days in New York gave us the opportunity to meet with a broad-based group of financial services companies, largely based in the U.S., but several operating globally. Included in the mix were several holdings of the Hamilton Global Financials Yield ETF (ticker: HFY) and the Hamilton U.S. Mid-Cap Financials ETF (USD) (ticker: HFMU.U), both of which invest in the broader financials services sector. The former…

What U.S. Investment Bankers and Banks are Saying about M&A

At Hamilton ETFs, the prospects for M&A is one the supporting factors for our investment thesis for the U.S. mid-cap banks, in which both the Hamilton Global Bank ETF (ticker: HBG) and Hamilton U.S. Mid-Cap Financials ETF (USD) (ticker: HFMU.U) are heavily-weighted[1]. Note to Reader: This Insight includes references to certain Hamilton ETFs that were active at the time of writing. On June 29, 2020, the…

Notes from Washington, DC – Investigating One of the Wealthiest MSAs in the Country

We recently had the opportunity to meet senior management of over a dozen U.S. mid-cap banks headquartered in the Washington, DC area. Anchored by the capital city, the Washington-Arlington-Alexandria MSA (Washington MSA) is the sixth largest U.S. MSA ([1]) with real GDP of US$507 bln ([2]) and a population of 6.3 mln. Importantly, it is also the second wealthiest MSA ([3]) in the entire country, supported…

HFY: Thriving in a Very Challenging Market (Supported by 4%+ Yield)

The Hamilton Global Financials Yield ETF (HFY) continues to thrive in a very challenging market, generating excellent returns, with much lower volatility. Year-to-date, HFY has risen ~13.0%, over 800 bps ahead of its benchmark of higher yielding financials[1]. It is also outperforming with lower downside volatility than the Canadian banks, global financials, U.S. banks (both large and mid-cap), European financials/banks, and major financials indices in Asia…

Cdn/Aust’n Financials: Fraternal Twins w/ Low Correlations & Near Identical Risk Rewards

The Australian financial sector is among the highest quality and strongest in the world. It is also very similar to the Canadian financial sector. Arguably, there are no two financial sectors globally that more closely resemble each other than Canada and Australia. A desire to provide Canadians with exposure to this great sector is why we launched the Hamilton Australian Financials Yield ETF (HFA), which has…

Scotia’s Pacific Alliance and Five Takeaways on Global Growth

Last week, Bank of Nova Scotia reported its Q3 results and its International Banking division generated solid double-digit earnings growth, supported by a strong economic backdrop and acquisitions. Within this segment is the Bank’s operations in the Pacific Alliance, the Latin American trade bloc that includes Peru, Chile, Columbia, and Mexico. This very large emerging markets platform has over $100 bln in loans, generates earnings of…

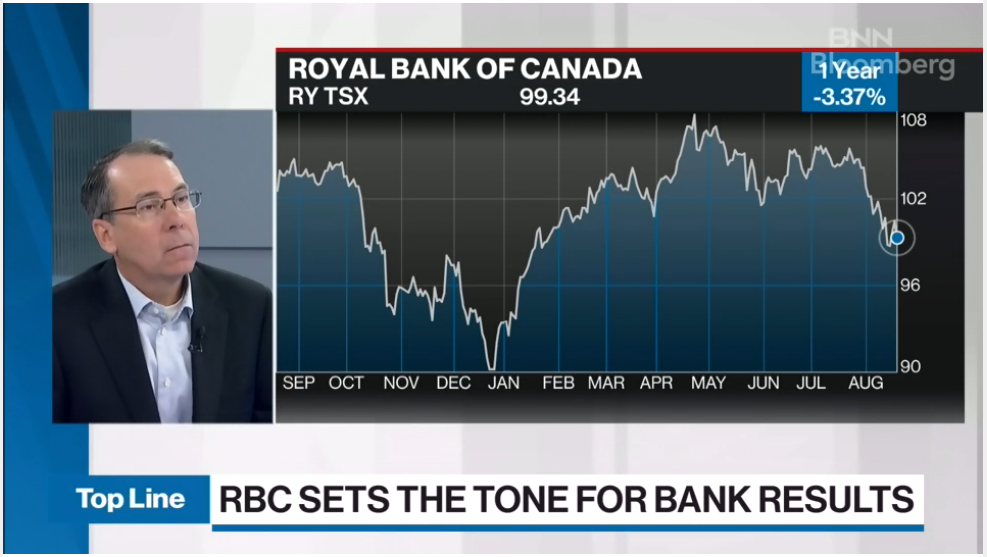

BNN Bloomberg: Royal Bank Q3 Earnings & Canadian Banks Outlook

Rob Wessel was on BNN Bloomberg this morning to discuss Q3 earnings results for RBC and our outlook for the Canadian banks and the Hamilton Canadian Bank Variable-Weight ETF (HCB). Click here to watch the interview. Note to Reader: This Insight includes references to certain Hamilton ETFs that were active at the time of writing. On June 29, 2020, the following mergers took place: (i) Hamilton Global…

European Banks in Charts: Credit Normalization vs. Margins

The European banking sector includes some of the world’s largest banks, making its health and profitability very important to the global markets. Given the sustained weakness in the sector (the STOXX Europe 600 Banks has fallen ~30% since the beginning of 2018), we thought it would be helpful to review key balance sheet and income statement trends – in 14 charts – since the European sovereign…