In April we wrote an Insight in which we explained why we believed the volatility of Canadian bank stocks was likely to rise[1]. Specifically, we cited two reasons: (i) rising acquisition risk, and (ii) implementation of the new provision accounting (IFRS 9). Since the first reporting season (February 2018) following the introduction of this new provision accounting, it does appear that the monthly volatility for the…

Insights: Canadian Banks

Cdn/Aust’n Financials: Fraternal Twins w/ Low Correlations & Near Identical Risk Rewards

The Australian financial sector is among the highest quality and strongest in the world. It is also very similar to the Canadian financial sector. Arguably, there are no two financial sectors globally that more closely resemble each other than Canada and Australia. A desire to provide Canadians with exposure to this great sector is why we launched the Hamilton Australian Financials Yield ETF (HFA), which has…

Scotia’s Pacific Alliance and Five Takeaways on Global Growth

Last week, Bank of Nova Scotia reported its Q3 results and its International Banking division generated solid double-digit earnings growth, supported by a strong economic backdrop and acquisitions. Within this segment is the Bank’s operations in the Pacific Alliance, the Latin American trade bloc that includes Peru, Chile, Columbia, and Mexico. This very large emerging markets platform has over $100 bln in loans, generates earnings of…

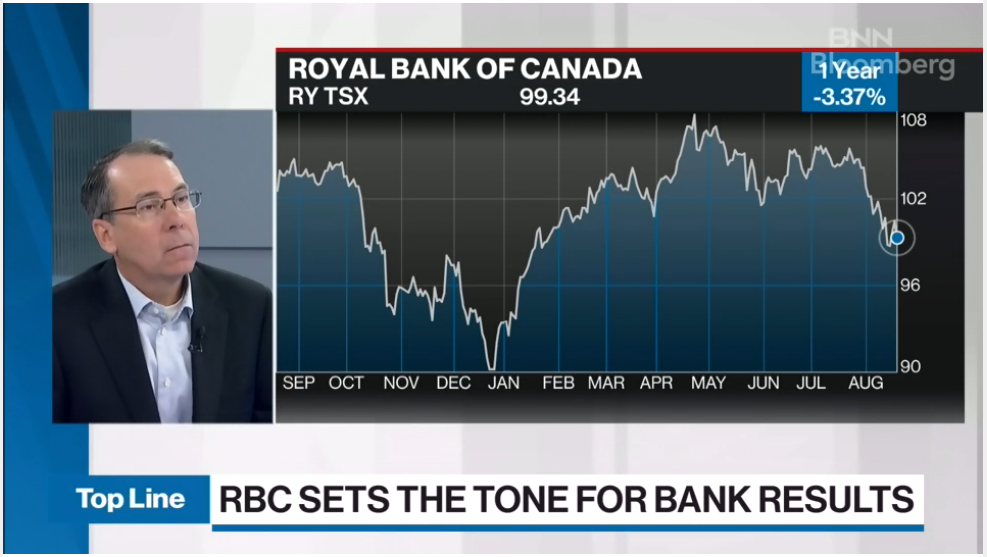

BNN Bloomberg: Royal Bank Q3 Earnings & Canadian Banks Outlook

Rob Wessel was on BNN Bloomberg this morning to discuss Q3 earnings results for RBC and our outlook for the Canadian banks and the Hamilton Canadian Bank Variable-Weight ETF (HCB). Click here to watch the interview. Note to Reader: This Insight includes references to certain Hamilton ETFs that were active at the time of writing. On June 29, 2020, the following mergers took place: (i) Hamilton Global…

Canadian Banks: Why Volatility Will Likely Rise (and a Comment on Mean Reversion)

In October 2018, we launched the Hamilton Capital Canadian Bank Variable-Weight ETF (ticker: HCB), which seeks to benefit from the historical mean reversion tendencies of the Big-6 banks, especially in times of greater market volatility. At the end of each month, the three most oversold banks are rebalanced to represent ~80% of HCB, while the three most overbought banks are rebalanced to 20%. HCB’s objective is…

Cdn/Aust’n Banks: Why the Big Housing Short is So Difficult (and the Risk of a “Direct Hit” Remains Low)

In Q4 2018, we expanded our ETF offering to include two ETFs with monthly distributions and exposure to two world-class – and very similar – financial sectors with excellent performance histories. In October, we launched the Hamilton Capital Canadian Bank Variable-Weight ETF (HCB), a rules-based strategy that seeks to capitalize on the historical mean reversion tendencies of the Canadian banking sector[1]. In December, we launched the…

Canadian Banks: Five Takeaways from BBT/STI, Accelerating U.S. Bank M&A

Last week, in our insight “U.S. Bank M&A: Implications of the Largest Deal in a Decade”, we explained why we expect U.S. bank consolidation will accelerate following the BB&T/SunTrust merger, and reasons why such activity will predominately be within the small and mid-cap banks. In this insight, we offer five takeaways for the Canadian banks – BMO, CM, RY, and TD – and their U.S. expansion…

Pref ETFs Falter (Again): Why HFA/HCB are Logical Switch Candidates for Monthly Income

Following our October launch of the Hamilton Capital Canadian Bank Variable-Weight ETF (HCB), today we launched the Hamilton Capital Australian Financials Yield ETF (HFA). Both of these ETFs pay monthly dividends. HFA seeks to generate a yield of 6.5% or higher from a portfolio of higher dividend-paying Australian financials operating in arguably the world’s strongest and safest financial sector (aided by covered calls). Of note, the…

Australian Banks Outperformed the Canadian Banks During the Global Financial Crisis

It is well known that the Canadian banks performed very well during the financial crisis relative to their global peers, and the U.S. banks in particular. However, what is less well known is that the Australian banks did even better than the Canadian banks, generating higher returns from 2007 through 2009, the years encompassing the financial crisis (see chart below). As we explain in “Dividend-Heavy Australian…

Dividend-Heavy Australian Financials: History of Outperformance vs. Canadian Peers

All Canadian bank investors know that the sector has experienced very good performance over the past ten to fifteen years. However, most are less familiar with Australia, which actually has a history of long-term outperformance relative to the Canadian financials, with virtually identical volatility. Interestingly, as a testament to the strength of the Australian financial sector, its banks even outperformed the Canadian banks during the global…

HCB: A New Strategy for Bank Investors (Wealth Professional Article)

Wealth Professional interviewed Rob Wessel, Managing Partner at Hamilton Capital, following the launch of the Hamilton Capital Canadian Bank Variable-Weight ETF (HCB). The interview covers mean reversion trends and how they are incorporated into HCB, how the strategy might lower risk in period of market turbulence. Click here to read more.

U.S. Financials | Mid-Caps Longer-Term Outperformance in One Chart

Given the media attention given to the U. S. large-cap financials (e.g., JPM, MetLife, AIG), Canadian investors can’t be faulted for sometimes neglecting to diversify into the very large and varied mid-cap financial sector south of the border. That said, in our view, investors should not overlook this important sub-sector given its long-term history of material outperformance relative to its better known large-cap peers, as evidenced…