In today’s volatile market environment, investors focused on long-term growth face a key challenge: how to stay invested in equities while managing risks such as inflation, interest rate uncertainty, geopolitical events, and policy shifts.

The Hamilton Enhanced Mixed Asset ETF (MIX) combines equities, bonds, and gold with modest leverage to provide enhanced growth potential while aiming to reduce volatility and drawdowns. Specifically, MIX is designed to track 1.25x the performance of the Solactive Hamilton Mixed Asset Index (“Mixed Asset Index”), offering a modern, all-in-one portfolio solution to help investors navigate today’s complex markets with greater resilience.

MIX — A New All-In-One Alternative to Stocks

MIX is a modern, diversified ETF designed to deliver long-term capital appreciation by applying modest 25% leverage to a balanced portfolio of three complementary asset classes:

- 60% U.S. Equities: Providing growth potential through exposure to high-quality U.S. stocks

- 20% U.S. Long-Term Treasury Bonds: Maintaining a defensive allocation to mitigate market downturns

- 20% Gold: Improving portfolio resilience with a historical hedge against inflation and economic uncertainty

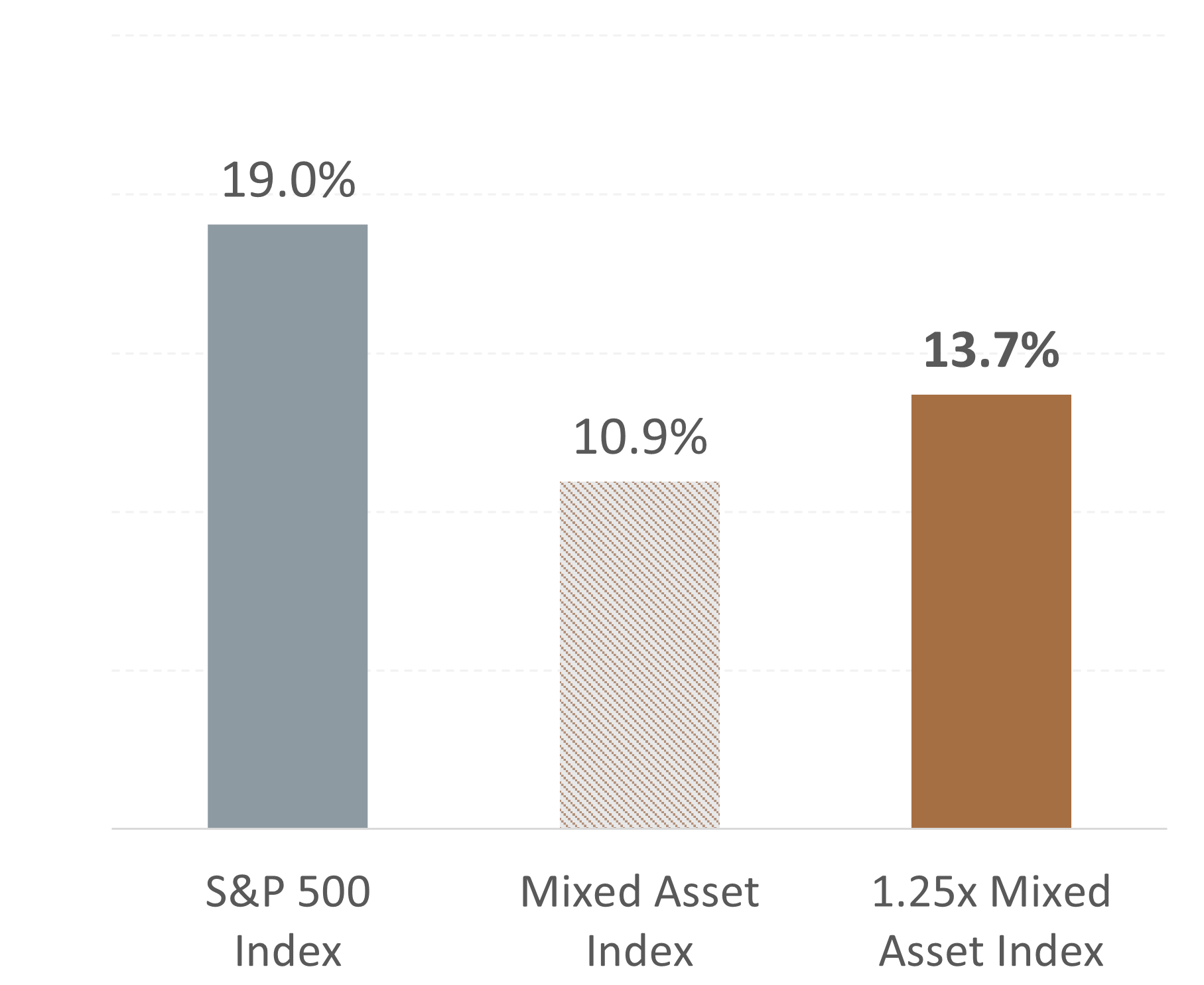

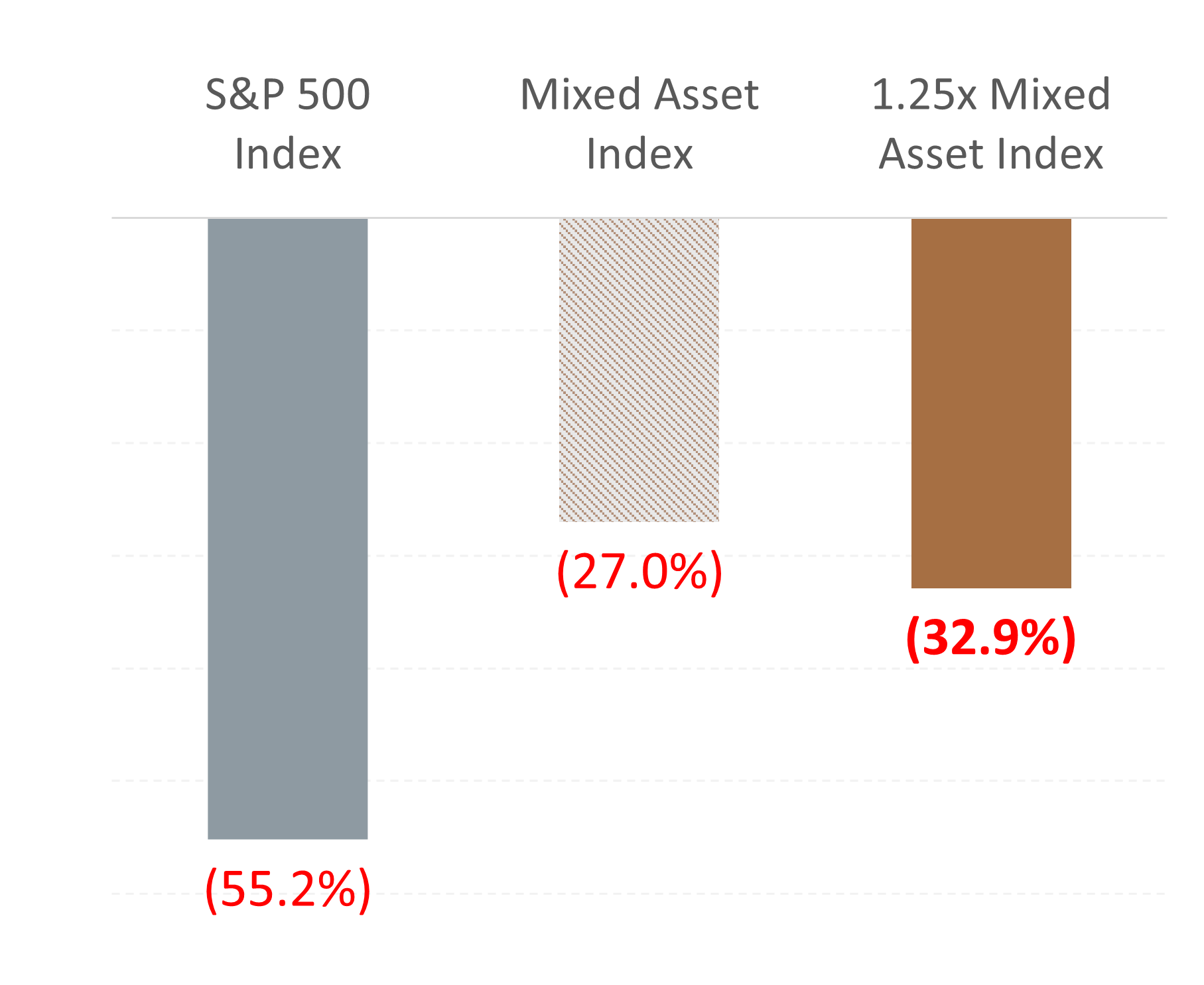

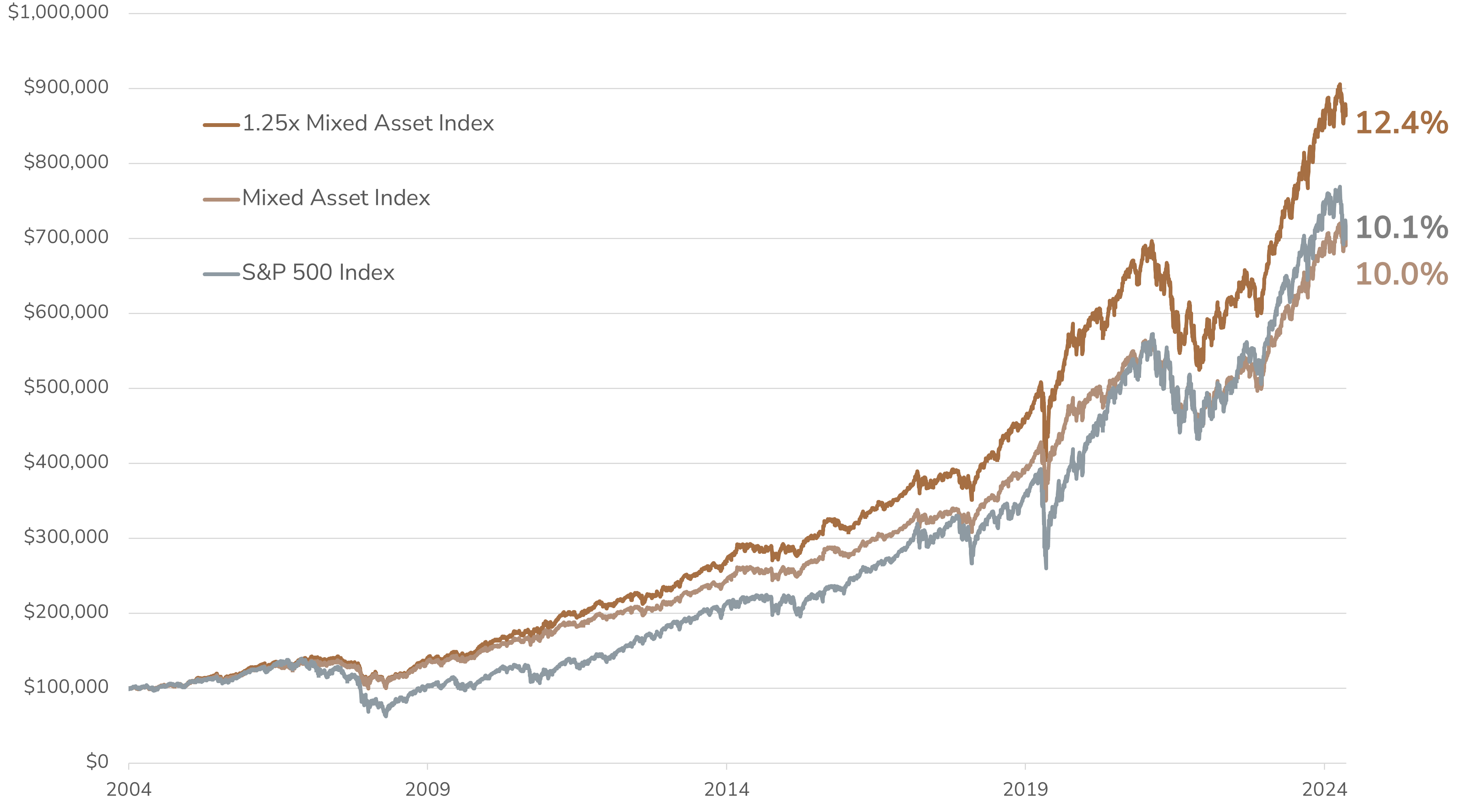

A 60/20/20 allocation across equities, bonds, and gold, respectively, enhances diversification to reduce overall portfolio volatility and drawdowns. The improved risk profile is such that even with 25% leverage applied, the combination has historically delivered lower volatility and drawdowns than equities only — while also generating higher returns (see 1.25x Mixed Asset Index vs. S&P 500 Index in charts below).

Outperformance — Mixed Asset Index (60/20/20)[1]

| Mixed Asset Index | 1.25x Mixed Asset Index |

S&P 500 Index | ||

| Annualized Return [1] | Stronger Returns | 10.0% | 12.4% | 10.1% |

| Standard Deviation [2] | Lower Volatility | 10.9% | 13.7% | 19.0% |

| Max Drawdown [3] | Lower Peak-to-Trough Drawdown | (27.0%) | (32.9%) | (55.2%) |

| Time to Recovery [4] | Faster Trough-to-Peak Recovery | ~12 months | ~16 months | ~37 months |

Adding Bonds & Gold Into the MIX

Bonds and gold play valuable roles in MIX by offering the following benefits:

Benefits of U.S. Government Bonds

- Diversification: Low correlation with equities helps reduce overall portfolio volatility

- Capital Preservation: Lower volatility and the backing of the U.S. government help protect portfolio value during market downturns

- Stable Income: Regular interest payments provide a consistent income stream to the portfolio

Benefits of Gold

- Inflation Hedge: Historically, gold has maintained its value during inflationary periods, helping preserve purchasing power

- Low Correlation: Gold’s price movements have historically been independent of equity and fixed-income markets, making it a stabilizing asset

- Crisis Protection: Gold often outperforms during market stress and geopolitical instability, providing an additional layer of defense

MIX — Key Benefits for Investors

- Greater Diversification: A broader asset mix reduces dependence on any single market segment

- Enhanced Risk-Adjusted Returns: The low correlation between equities, bonds, and gold helps optimize portfolio performance

- Inflation Protection: Gold provides a hedge against rising prices and currency devaluation

- Lower Drawdowns: Reduced portfolio volatility helps limit losses during market downturns

- A Strong Core Holding: MIX is designed to be able to serve as a foundational investment within a well-constructed portfolio

We believe investors looking for a more effective way to navigate today’s complex financial markets should consider the Hamilton Enhanced Mixed Asset ETF (MIX). With its innovative 60/20/20 allocation to stocks, bonds, and gold, respectively, and modest leverage, MIX, in our view, offers a solution for better risk-adjusted returns, and greater resilience, making it a compelling option for investors seeking a core portfolio holding that can withstand changing market conditions while maximizing long-term growth potential.

For more commentary, subscribe to our Insights.

____

A word on trading liquidity for ETFs …

Hamilton ETFs are highly liquid ETFs that can be purchased and sold easily. ETFs are as liquid as their underlying holdings and the underlying holdings trade millions of shares each day.

How does that work? When ETF investors are buying (or selling) in the market, they may transact with another ETF investor or a market maker for the ETF. At all times, even if daily volume appears low, there is a market maker – typically a large bank-owned investment dealer – willing to fill the other side of the ETF order (at net asset value plus a spread). The market maker then subscribes to create or redeem units in the ETF from the ETF manager (e.g., Hamilton ETFs), who purchases or sells the underlying holdings for the ETF.

____

Commissions, management fees and expenses all may be associated with investments in exchange traded funds (ETFs) managed by Hamilton ETFs. Please read the prospectus before investing. Indicated rates of return are the historical annual compounded total returns including changes in per unit value and reinvestment of all dividends or distributions and does not take into account sales, redemptions, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. Only the returns for periods of one year or greater are annualized returns. ETFs are not guaranteed, their values change frequently and past performance may not be repeated.

Certain statements contained in this website may constitute forward-looking information within the meaning of Canadian securities laws. Forward-looking information may relate to a future outlook and anticipated distributions, events or results and may include statements regarding future financial performance. In some cases, forward-looking information can be identified by terms such as “may”, “will”, “should”, “expect”, “anticipate”, “believe”, “intend” or other similar expressions concerning matters that are not historical facts. Actual results may vary from such forward-looking information. Hamilton ETFs undertakes no obligation to update publicly or otherwise revise any forward-looking statement whether as a result of new information, future events or other such factors which affect this information, except as required by law.

____

[1] Annualized Return: The annualized total rate of return. Source: S&P Global, Solactive AG, Hamilton ETFs. Data from November 18, 2004, to March 31, 2025.

The graph illustrates the growth of an initial investment of $100,000 in USD the Solactive Hamilton Mixed Asset Index (SOLHAMMA) vs. the S&P 500 Total Return Index with annual compounded total returns and the potential impact of 1.25x leveraged exposure to SOLHAMMA. The graph is for illustrative purposes only and intended to demonstrate the historical impact of the indexes compound growth rate. It is not a projection of future index performance, nor does it reflect potential returns on investments in the ETF. Investors cannot directly invest in the index. All performance data assumes reinvestment of distributions and excludes management fees, transaction costs, and other expenses which would have impacted an investor’s returns. SOLHAMMA data prior to March 31, 2025, is hypothetical back-tested data using actual historical market data. Actual performance may have been different had the index been live during that period. The S&P 500 Index (“Index”) and associated data are a product of S&P Dow Jones Indices LLC, its affiliates and/or their licensors and has been licensed for use by Hamilton ETFs © 2025 S&P Dow Jones Indices LLC, its affiliates and/or their licensors. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of Standard & Poor’s Financial Services LLC (“SPFS”) and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). Neither S&P Dow Jones Indices LLC, SPFS, Dow Jones, their affiliates nor their licensors (“S&P DJI”) make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and S&P DJI shall have no liability for any errors, omissions, or interruptions of any index or the data included therein.

[2] Source: S&P Global, Solactive AG, Hamilton ETFs. Data from November 18, 2004, to March 31, 2025.

Volatility is measured using standard deviation, which quantifies how much an investment’s returns deviate from its average return over a given period.

[3] Source: S&P Global, Solactive AG, Hamilton ETFs. Data from November 18, 2004, to March 31, 2025.

Drawdown: The percentage drop from an investment’s peak value to its lowest point.

[4] Time to Recovery: The time it takes for an investment to recover from a drawdown and reach its previous peak value.

These projections are uncertain and may be influenced by factors such as market volatility, economic conditions, and company performance. Investors should not rely solely on these projections when making investment decisions. Past performance is not indicative of future results. Investors cannot directly invest in the index. All performance data assumes reinvestment of distributions, and excludes management fees, transaction costs, and other expenses which would have impacted an investor’s results. Solactive Hamilton Mixed Asset Index (Mixed Asset Index) data prior to March 26, 2025, is hypothetical back-tested data using actual historical market data. Actual performance may have been different had the index been live during that period.