The healthcare sector remains an industry of focus for investors looking for both resilience and long-term growth. Unlike cyclical industries, healthcare tends to benefit from consistent demand, as medical needs persist regardless of economic conditions. Aging populations, rising chronic disease rates, and ongoing advancements in treatments ensure that healthcare spending is more a necessary expense than a discretionary one. This built-in demand, coupled with breakthroughs in biotechnology, medical devices, and pharmaceuticals, creates a rare blend of stability and innovation-driven upside to earnings.

For Canadian investors, accessing this opportunity can be challenging due to the smaller size and limited number of publicly traded healthcare companies in Canada. However, the U.S. healthcare sector—home to some of the world’s largest and most innovative healthcare firms—offers a much broader investment landscape. Recognizing this, we launched the Hamilton Healthcare YIELD MAXIMIZER™ ETF (LMAX) in February 2024, offering an income-focused way to invest in this critical sector. With a 12.02% distribution yield[1], LMAX is the highest-yielding healthcare ETF[2], providing access to leading U.S. healthcare companies while maintaining modest growth potential.

LMAX Highlights

One year after launch, LMAX has delivered on its investment objective, providing high monthly income to investors while capturing much of the growth from leading U.S. healthcare companies.

- Current Annualized Yield: 12.02%[1] (monthly distributions)

- Annualized Total Return: +10.66%[3]

- Distribution Growth: $0.1466 → $0.1570 (+7%)

- Assets Under Management (AUM): $115 million[4]

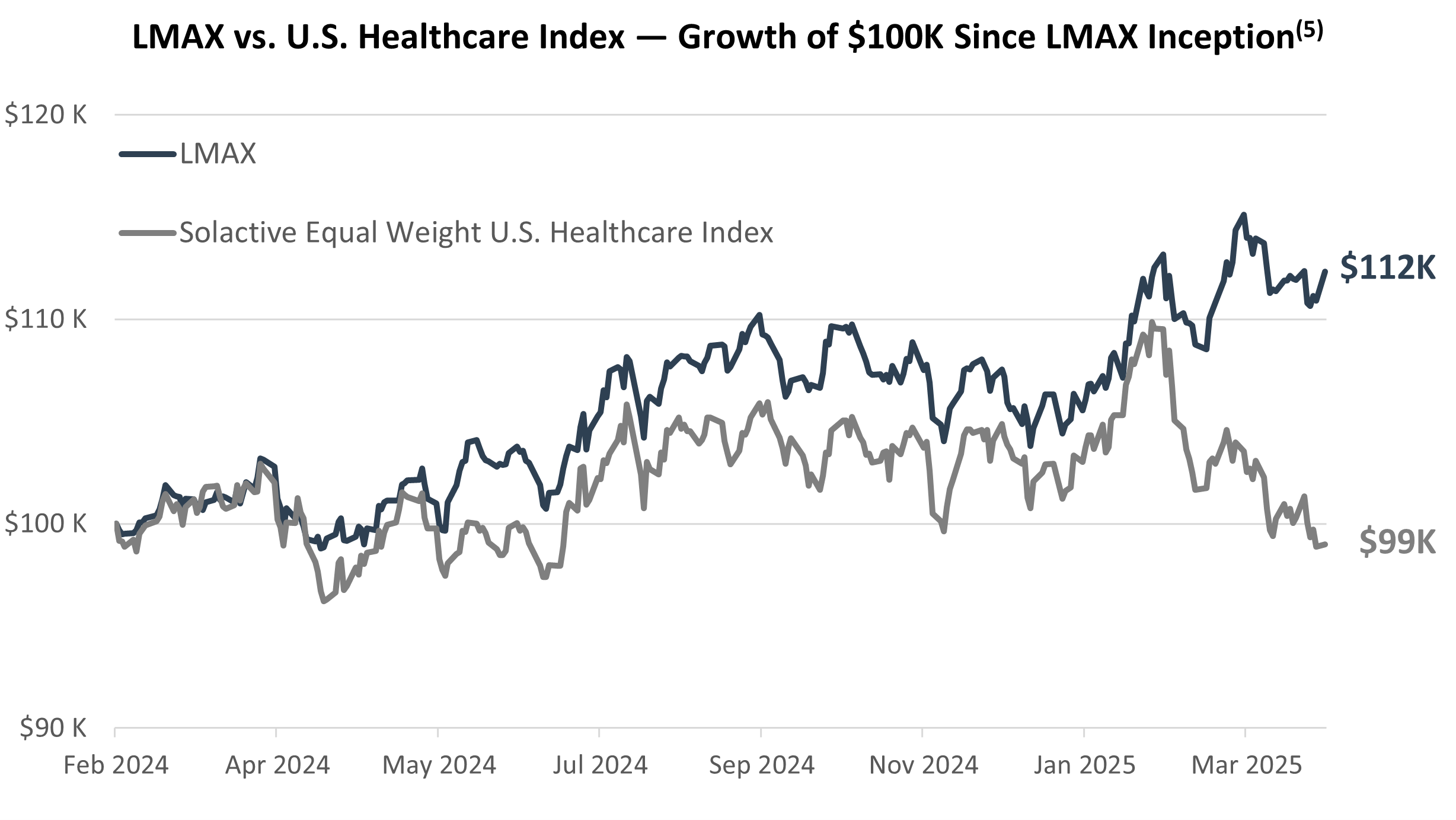

- Outperforming U.S. Healthcare Index [5]

| Name | Yield | 6M | YTD | 1-YR | Since LMAX inception* | Since Inception* | Inception Date |

| Hamilton Healthcare YIELD MAXIMIZER™ ETF (LMAX) | 12.02% | 4.36% | 7.13% | 8.93% | 10.66% | 10.66% | 2024/02/06 |

| Solactive Equal Weight U.S. Healthcare Index | – | -3.74% | -2.56% | -3.62% | -0.88% | 8.85% | 2016/05/18 |

* Annualized

A High-Yield Approach to Healthcare Equity Leaders

Since its inception, LMAX has provided investors with a unique way to generate higher tax-efficient income from high-quality U.S. healthcare companies while still capturing most of the sector’s upside. To achieve this, LMAX employs a covered call strategy on approximately 30% of its holdings, generating income while maintaining ~70% exposure to upside growth potential. LMAX invests in U.S. healthcare equity leaders—the largest and most established companies spanning pharmaceuticals, biotechnology, medical devices, and healthcare services. This focus ensures a strong foundation for the portfolio, featuring businesses with a proven track record of stability, innovation, and performance.

Key Benefits to Investors

- Higher Income: Highest-yielding healthcare ETF in Canada[2]

- Diversification: Access to a basket of leading pharmaceutical, biotech, and medical technology companies driving innovation and long-term growth

- Tax Efficiency: Covered call premiums are generally taxed as capital gains

- Dynamic Strategy: Flexible coverage ratio to maximize income while maintaining ~70% upside equity potential in the healthcare sector

- Experience: Managed by a team with 40+ years of combined experience.

An Income-First Strategy Focused on Healthcare Equity Leaders

At the core of LMAX is its income-first covered call strategy. The ETF holds an equal-weight portfolio of 20 large-cap U.S. healthcare stocks, including Johnson & Johnson, UnitedHealth Group, Eli Lilly, and Thermo Fisher Scientific, with rebalancing occurring semi-annually.

To enhance income, LMAX employs a covered call strategy by selling at-the-money (ATM) call options on approximately 30% of the portfolio, generating additional cash premiums while maintaining ~70% exposure to potential capital appreciation.

For investors looking to maximize their monthly income while gaining exposure to leading U.S. healthcare stocks, we believe the Hamilton Healthcare YIELD MAXIMIZER™ ETF (LMAX) presents an attractive solution

For additional information on our suite of YIELD MAXIMIZER™ ETFs, please CLICK HERE.

For more commentary, subscribe to our Insights.

____

A word on trading liquidity for ETFs …

Hamilton ETFs are highly liquid ETFs that can be purchased and sold easily. ETFs are as liquid as their underlying holdings and the underlying holdings trade millions of shares each day.

How does that work? When ETF investors are buying (or selling) in the market, they may transact with another ETF investor or a market maker for the ETF. At all times, even if daily volume appears low, there is a market maker – typically a large bank-owned investment dealer – willing to fill the other side of the ETF order (at net asset value plus a spread). The market maker then subscribes to create or redeem units in the ETF from the ETF manager (e.g., Hamilton ETFs), who purchases or sells the underlying holdings for the ETF.

____

Commissions, management fees and expenses all may be associated with investments in exchange traded funds (ETFs) managed by Hamilton ETFs. Please read the prospectus before investing. Indicated rates of return are the historical annual compounded total returns including changes in per unit value and reinvestment of all dividends or distributions and does not take into account sales, redemptions, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. Only the returns for periods of one year or greater are annualized returns. ETFs are not guaranteed, their values change frequently and past performance may not be repeated.

Certain statements contained in this website may constitute forward-looking information within the meaning of Canadian securities laws. Forward-looking information may relate to a future outlook and anticipated distributions, events or results and may include statements regarding future financial performance. In some cases, forward-looking information can be identified by terms such as “may”, “will”, “should”, “expect”, “anticipate”, “believe”, “intend” or other similar expressions concerning matters that are not historical facts. Actual results may vary from such forward-looking information. Hamilton ETFs undertakes no obligation to update publicly or otherwise revise any forward-looking statement whether as a result of new information, future events or other such factors which affect this information, except as required by law.

____

[1] An estimate of the annualized yield an investor would receive if the most recent distribution remained unchanged for the next 12 months, stated as a percentage of the price per unit on March 31, 2025. The yield calculation excludes any additional year end distributions and does not include reinvested distributions.

[2] As at March 31, 2025. Based on a universe of 29 healthcare ETFs that trade on the Toronto Stock Exchange, including non-covered call strategies.

[3] As at March 31, 2025, since inception, February 6, 2024.

[4] As at March 31, 2025

[5] Source: Bloomberg, Hamilton ETFs. As of March 31, 2025. The graph illustrates the impact to an initial investment of $100,000. It is not intended to reflect future returns on investments in LMAX. The index performance returns are for illustrative purposes only, and the returns do not reflect any management fees, transaction costs or expenses. Investors cannot invest directly in an index.