HAMILTON CHAMPIONS™ Enhanced Canadian Dividend ETF

Dividend Growers, Built to Win

HIGHLIGHTS

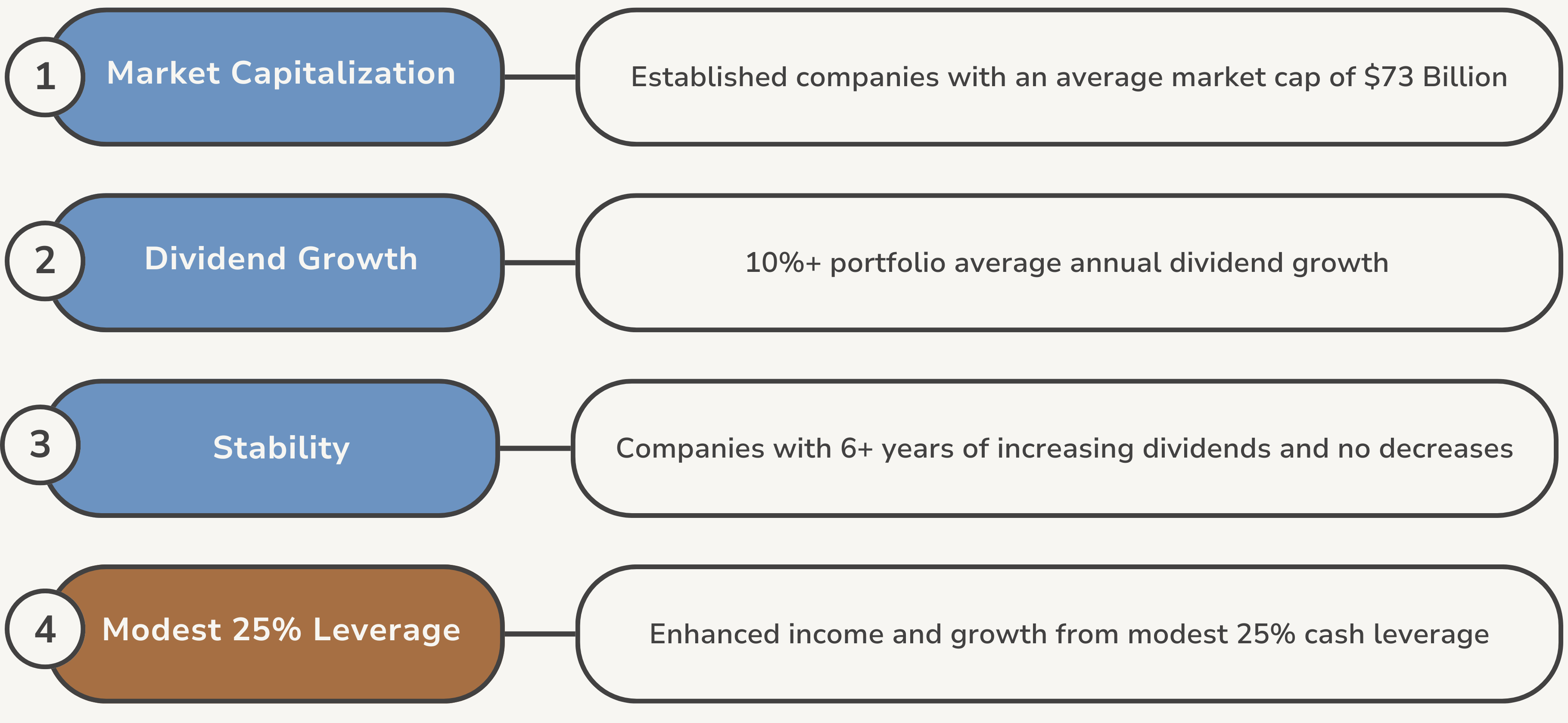

Equal-weight portfolio of blue-chip Canadian companies with a long history of stable and increasing dividend payments

Modest 25% cash leverage to enhance long-term growth potential

Available without modest 25% leverage (CMVP)

A GOOD FIT FOR INVESTORS WHO WANT

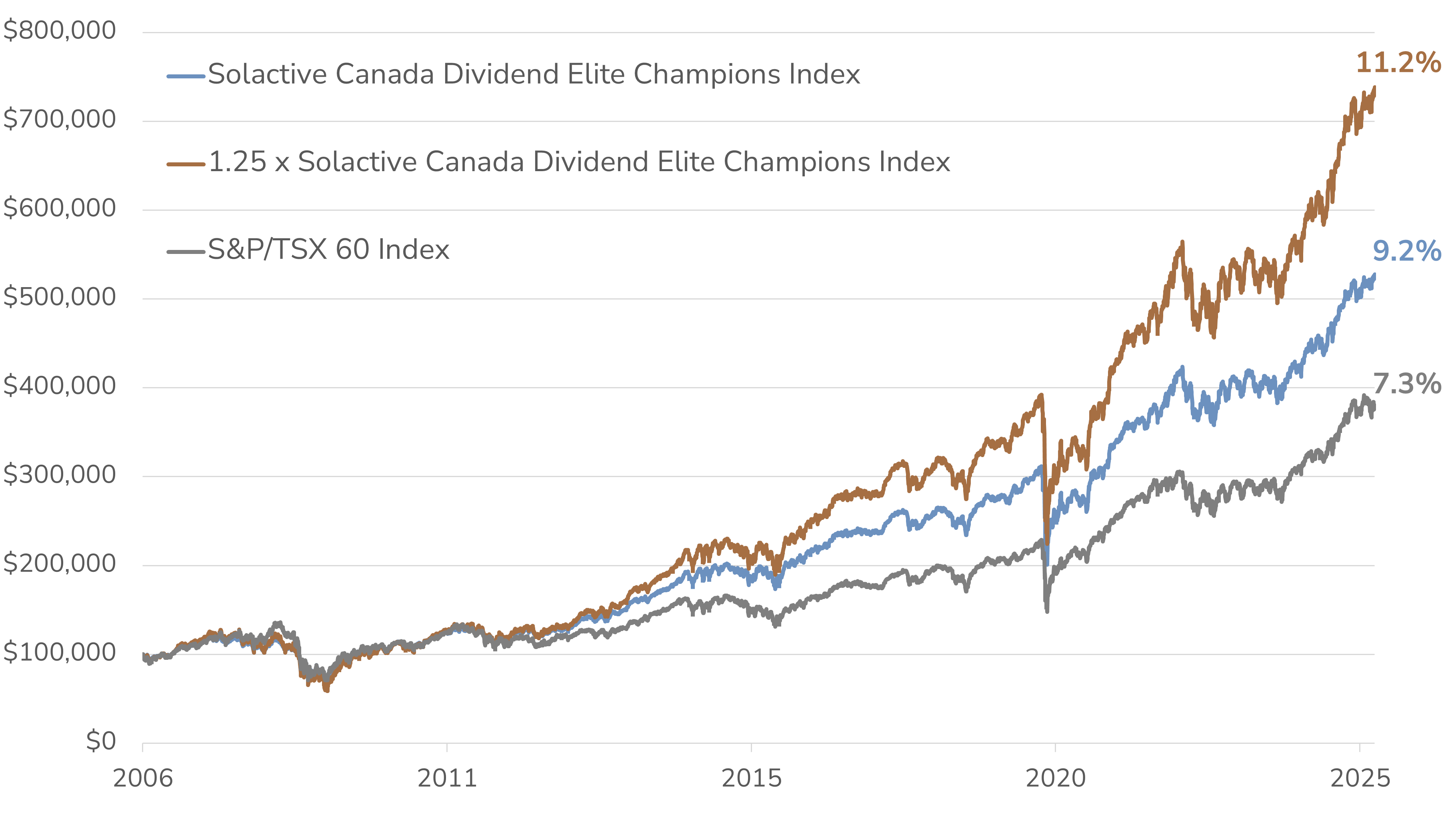

Index Outperformance vs. S&P/TSX 60*Based on the total return of 1.25x leveraged exposure to Solactive Canada Dividend Elite Champions Index (SDLCACT) vs. S&P/TSX 60 Index. Since November 1, 2006, as at February 28, 2025. SDLCACT data prior to December 31, 2024 is hypothetical back-tested data using actual historical market data. Source: Bloomberg, Solactive AG, Hamilton ETFs

Tax efficiency from Canadian eligible dividends

Monthly Distributions

Performance

- TICKER CWIN

- NAV $16.02

- 1 DAY CHANGE +$0.00

-

LAST DISTRIBUTION *

Last distribution per unit. Distributions are subject to change. For a complete list of historical distributions, please see the Distributions tab below.

$0.056 - ASSETS $6.6M

CWIN — Index Outperformance vs. S&P/TSX 60

DISCLAIMERSource: Bloomberg, Solactive AG. Data from May 8, 2006 to March 31, 2025.

The graph illustrates the growth of an initial investment of $100,000 in the Solactive Canada Dividend Elite Champions Index (SDLCACT) vs. the S&P/TSX 60 Total Return Index with annual compounded total returns and the potential impact of 1.25x leveraged exposure to SDLCACT. The graph is for illustrative purposes only and intended to demonstrate the historical impact of compounding returns and the use of leverage. It is not a projection of future index performance, nor does it reflect potential returns on investments in the ETF. Investors cannot directly invest in the index. All performance data assumes reinvestment of distributions and excludes management fees, transaction costs, borrowing costs, and other expenses which would have impacted an investor’s returns. SDLCACT data prior to December 31, 2024 is hypothetical back-tested data using actual historical market data. Actual performance may have been different had the index been live during that period.

CWIN — Portfolio Characteristics

Blue-Chip Canadian Dividend Champions

- Overview

- Distributions

- Documents

█ Energy 15.5%

█ Materials 14.9%

█ Industrials 11.5%

█ Consumer Staples 8.0%

█ Communication Services 7.7%

█ Consumer Discretionary 3.2%

█ Utilities 4.2%

| ticker | name | weight |

| CMVP | HAMILTON CHAMPIONS Canadian Dividend Index ETF | 124.80% |

To view CMVP holdings, please CLICK HERE.

| Ticker | CWIN |

| Exchange | Toronto Stock Exchange (TSX) |

| CUSIP | 407050103 |

| Inception Date | January 27, 2025 |

| Investment Style | Index-based, modest 25% leverage |

| Benchmark | Solactive Canada Dividend Elite Champions Index |

| Assets | $6.6M CAD* |

| Distributions | Monthly |

| Rebalancing | Quarterly |

| Management Fee | 0.65% |

| Risk Rating | Medium |

| Auditor | KPMG LLP |

| Legal Entity Identifier | 254900CG9LZU58J5XR67 |

| Ex-Dividend Date | Pay Date | Frequency | Amount |

|---|---|---|---|

| 2025-03-31 | 2025-04-07 | Monthly | $0.056 |

| 2025-02-28 | 2025-03-07 | Monthly | $0.056 |